risk. claims. policy. solutions

Risk Management Information System

ClaimsVISION RMIS

Management of incidents, claims, certificates, events, and more.

A centralized electronic headquarters that synthesizes everything important to a Risk Manager. ClaimsVISION RMIS isn’t about connecting dots; its about connecting worlds (departments, job functions, field operations, HR, Insurance), identifying risks and trends proactively, arming organizations with the tools to make corrections, and intelligently presenting the knowledge for exposure and cost consideration.

Intake

Whether it is reporting a risk, event, report only or multiple claims from an occurrence ClaimsVISION’s Incident Report Form (IRF) serves as a one stop shop for intake. This form is dynamic in nature and varies to ask the appropriate questions per LOB, state, department, or user. The IRF is customizable and can be accessed directly by employees/adjustors, third parties, or embedded into customer sites, or populated from other source systems.

Safety & Loss

Module for tracking occupational and workplace risks. Link an event, task, or report to a claim, location, department then track progress and results for:

Safety Meetings

Surveys

Audits

Risk Assessments

Corrective Action Plans

COI Management

Organize and track all of your entity’s Certificates of Insurance in a centralized place. Entities easily manage vendors, keep COI’s updated and compliant, and leverage automated alerts to keep COI’s from expiring.

ERM

Risk and claims core capabilities work in concert with optional modules across your organization for true enterprise RM:

Policy Management

Exposure, Allocation, TCOR

Doc Management

Collaboration Hub

TPA Management Toolset

Claims Administration

ClaimsVISION

Workers Comp, General Liability, Auto, Property & More

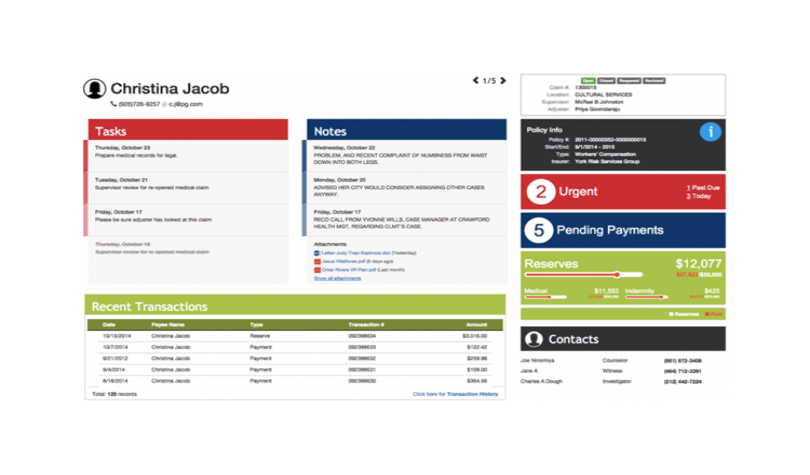

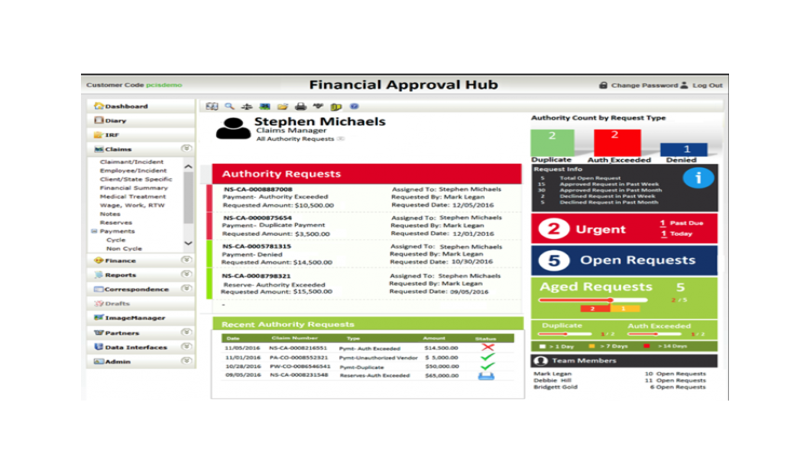

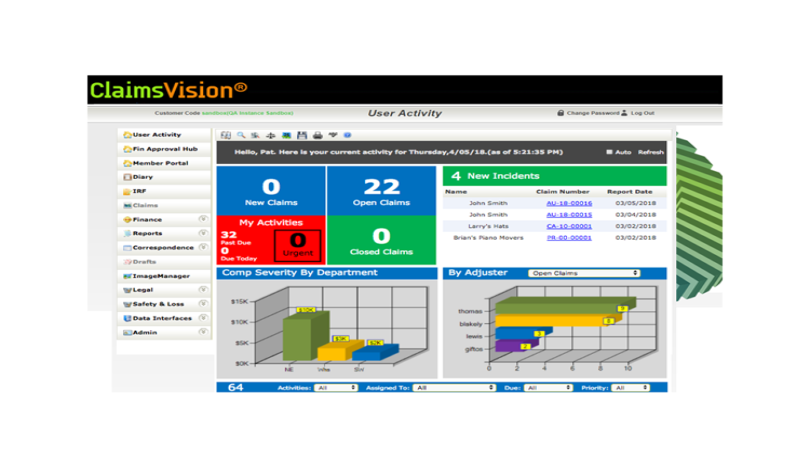

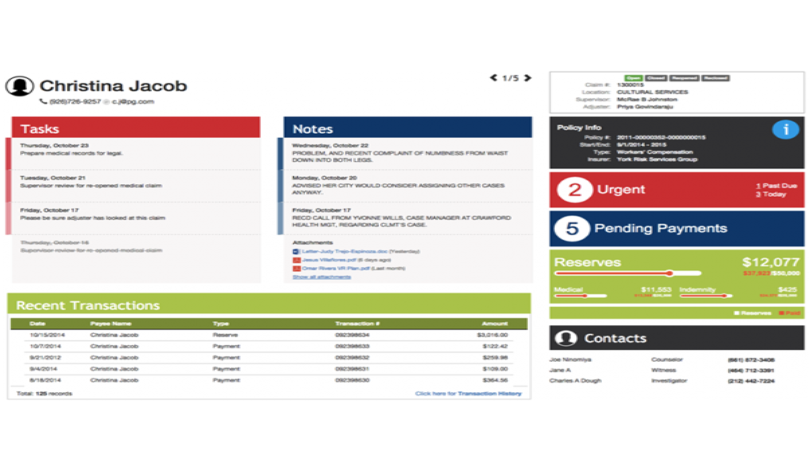

ClaimsVISION is a robust and modernly architected hosted solution that handles all aspects of claims management from intake to the close of a claim, including setting reserves, making payments and tracking litigation. ClaimsVISION also incorporates the tools to support the aforementioned functions such as diaries, notes, correspondence, and reporting. ClaimsVISION’s robust capabilities are driven by a user configurable unlimited hierarchy and an intelligent business rule engine. Integrated with the Microsoft suite of products, ClaimsVISION is intuitive, boasting state-of-the-art, highly functional dashboards that facilitate a streamlined claim-centric workflow.

Intake

Whether it is reporting a risk, event, report only or multiple claims from an occurrence ClaimsVISION’s Incident Report Form (IRF) serves as a one stop shop for intake. This form is dynamic in nature and varies to ask the appropriate questions per LOB, state, department, or user. The IRF is customizable and can be accessed directly by employees/adjustors, third parties, or embedded into customer sites, or populated from other source systems.

No Touch FROI SROI Reporting

The industry’s only truly automated FROI SROI EDI solution. Smart auto-triggers know each state’s claim activation points. From there FROIS and even SROIS are generates, coded, and sent for pre-validation. Lastly acknowledgements are brought directly to the users dashboard or in case of an error a notice to correct data- ALL BEFORE IT HITS THE STATE.

Smart Claims Flow

An intelligent rules engine coupled with an unlimited hierarchy allows an entity to build and configure their own workflows and ensure best practices. Whether it is auto reserving, adjustor routing rules, or alerts it can all be executed and maintained from the front end by an end user.

Analytics

An advanced reporting platform easy enough for an end user to master, without any technical expertise.

+100 Canned Reports

Drag & Drop Ad Hoc Reporting

Drag & Drop Ad Hoc Dashboarding

Reporting Database

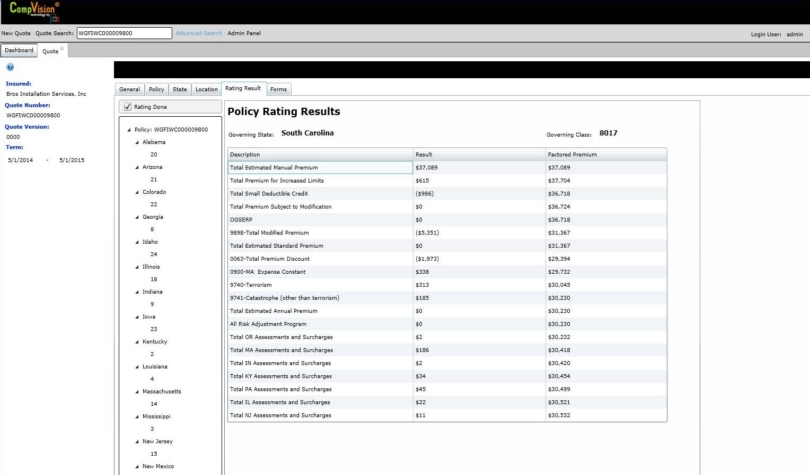

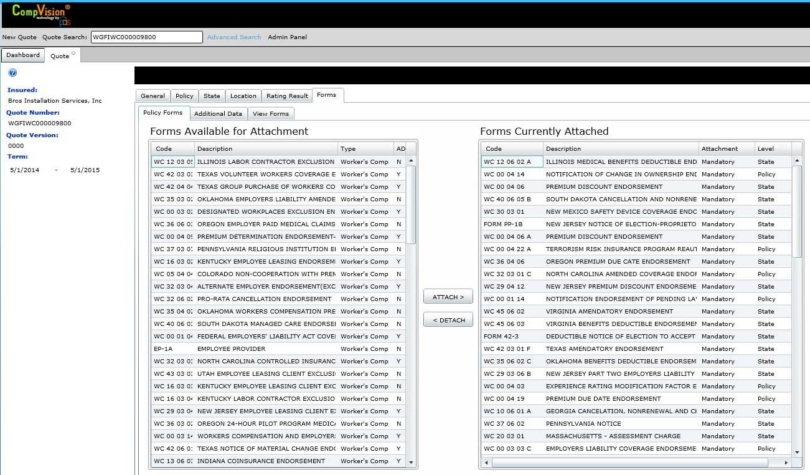

Policy Administration

CompVISION

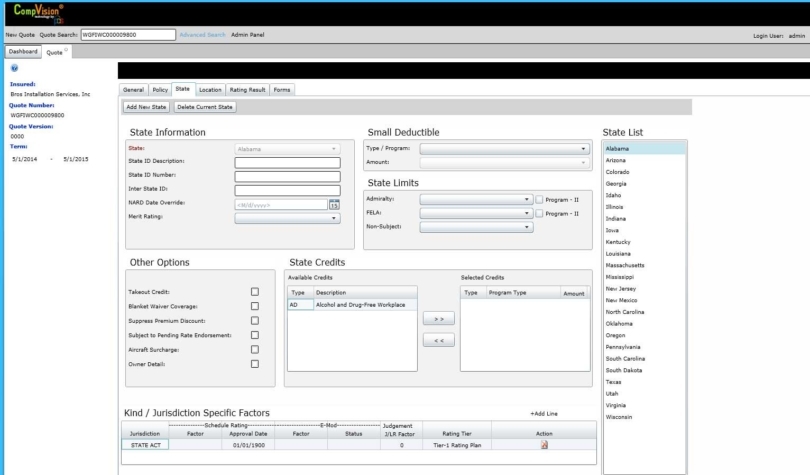

CompVISION Policy Management solution: a richly featured Workers Compensation policy administration system for insurance carriers, from start-ups and regional companies to large multi-state/multi-carrier companies. Our policy Management system is a 50-state, rate, quote, policy issuance, policy administration, premium accounting, audit, and NCCI/Bureau Statutory reporting software solution. The system manages the Workers Compensation business from initial assessments through final audit, fully integrating all accounting functions, reporting functions, and internal controls.

Policy Administration

Rate, Quote, and Issue with flexibility and compliance.

Store rates, rules, and conditions needed to write multi-state workers’ coverage in all jurisdictions.

Generate Multiple versions of quotes, allowing binding of an version

Complete endorsement processing (effective date, mid-term, pending rate change, anniversary rate dat, out of sequence

Billing

Premium Billing & Accounting

Direct & Agency Billing, Payroll Self Reporting (pay as you go)

Produce separate invoices at policy, state, entity, or location level

Intake cash and apply receipts to invoices

Generate comprehensive, real-time accounting reports

Commission Structure & Distribution

Single rate, sliding scale, or flat dollar

Automatic commission calculation and disbursments

Real-time online commission reports

Web Rating

Cloud Based Workers’ Comp Rating

CompVISION’s proprietary WC ratings engine now available as a standalone web rater.

Quick Quote

All NCCI Rates & Rules

Tailored Portal experience for UW, Brokers, or Agents

Granular, role-based, security

Compliance

Built-in content, maintained by regulatory bodies, coupled with an intelligent rules engine ensures compliance

NCCI

Unitstat Reporting

State Forms

FROI SROI Reporting

OFAC